This article is the third in a series.

By Larry A. Marks

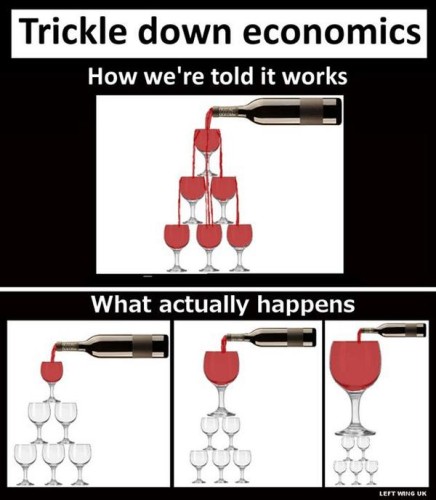

Here is the logic. (It is highly flawed logic and I’ll explain why we already know that but the GOP is ignoring that fact.)

They say, businesses create jobs. (Okay. So far, so good.) They say, as businesses grow they will hire more people. (Uh, oh. The logic just got a bit shaky.) They say, more jobs mean higher payrolls and more people who can buy consumer goods. (That sounds good, but are they really hiring more people or paying higher salaries as they increase their profits?)

So what is going on?

I’m not going to look up the actual number, but of the top 20 companies in the U.S., I bet 12 of them pay no taxes at all other than payroll and real estate taxes.

How on earth can that happen? They are selling their products in the U.S., making money, tons of money in the U.S. How can they pay no taxes?

The GOP has been saying that it’s simple: these are the “job creators.” We need to give them more and more tax breaks so they will create more and more jobs.

This is the “trickle-down” theory. It’s total nonsense, and it’s easy to see that.

The so-called job creators are not creating new jobs in any substantial numbers. Still, the employment figures are improving.

So what is really happening? Who is creating these jobs?

This is a fairly simple question. The economy goes through patterns of boom and recession on a regular, but unpredictable, basis. When we slide into a recession, the job market is impacted very heavily. That is not the most important factor in measuring a recession, but if you are out of a job, it’s number one to you.

What industry sectors lose employment first? Service industries–architects, doctors, restaurants–really any business that sells services such as advertising, marketing, consulting, etc. The second sector to shrink is light manufacturing and retail, which is followed by heavy manufacturing.

When an economic recovery occurs, as we are seeing right now, the first sector to rehire is service, followed by light manufacturing and retail, and then finally heavy manufacturing (which hires many, many workers, often unionized.) So the new jobs we are seeing are in large part the old jobs that were lost due to the recession, and the bulk take the longest to come back because they are tied to heavy manufacturing.

Now, there are those who will say, “Yes, but, it’s much more complex than this.” Well, maybe. There are certainly more factors to be considered, such as how many jobs did the large companies push offshore to India, China, and other cheap labor countries that will come back slowly or not at all. But I would contend it’s all the same damaged and selfish thinking as not raising wages as profits soar.

So what happens when we cut taxes on companies? The owners, shareholders in those firms, make more money by profit distributions called dividends. What do the employees get? They get to keep their low-paying jobs. How does this help the economy? It doesn’t. It only helps owners of the firms.

Is this true for all companies?

No, there are some very well-run, highly ethical firms out there that work hard to be fair to their employees, firms like Berkshire Hathaway and Costco. There are also those firms that have to get hit on the head a few times but they finally see the light. That’s McDonald’s.

Then there are those that seem not to care at all about the U.S., companies like Mobil, Exxon, Walmart. I’m sure you know the list as well as I do.

What is the solution?

Taxes are as low right now as they were during the administration of Harry S. Truman. Think about that for a minute. As a country, we are massively more complex, have broad global interests and a military that keeps watch worldwide, and our richest taxpayers are paying taxes that would be familiar to Truman.

Do we need to raise taxes on everyone? No, we don’t. The middle class is pretty much choking right now. If we reversed all the tax gifts we have given to the corporations that are larger than $1 billion in revenue and added a small increase in taxes to our wealthiest citizens, the debt would begin to erode very quickly. If we continue to give tax breaks to those most easily able to pay taxes, you can count on a very slow-moving economy for a very long time.